Travis County and Williamson County Property Tax Assessed Values were published in the last few weeks and it seems they are finally catching up with market values.

Many people are concerned with the sharp increase in their values, especially those who do not currently have a homestead exemption on the property. However, it’s important to remember that the tax rates have not yet been finalized, and that will not happen until much later in the year. Only then will we know exactly what the increase to our actual taxes will be.

Figuring out the property taxes is a year-long process:

| January 1 | Property values are set |

| mid-April | Notices of Appraised Value are sent out |

| May 15 | Deadline to file a protest |

| July 25 | Certification of appraisal roll |

| August/September | Tax rates set |

| October | Property tax bills begin to be mailed out |

| November | Voter approval elections are held |

| January 31 | Property tax bill payments due |

One would hope that all of the taxing entities are fiscally responsible and won’t need (or use just because it’s available) the extra money from increased assessments, and will lower the tax rates. The only way we as taxpayers can control this is through our votes.

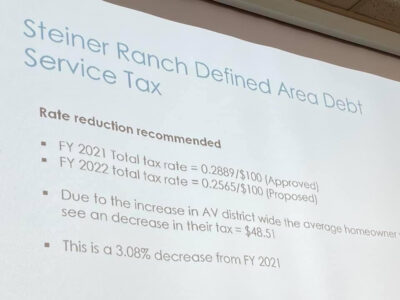

The board of directors for WCID #17, one of the taxing entities for Steiner Ranch, did vote earlier in the year to reduce the tax rate for the Steiner Ranch defined area for 2022. They also voted to lower the District Tax Rate as well it will go down from 0.0599 to 0.0568.

You also have the opportunity to vote on issues that will impact our property taxes tomorrow, May 7, 2022. I voted early and can tell you that they are confusing as written on the ballot, so I recommend researching your stance ahead of time. Polling Locations can be found here.