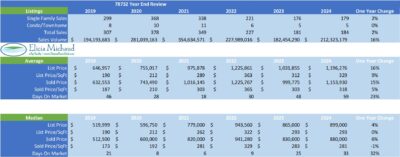

Inventory – Number of Sales

List Price to Sales Price Ratio

In 2024, the average sale price to original list price ratio was 92.9%, while the sale price to list price at the time a home went pending was 96.87%. Interestingly, both of these figures are worse than in 2023, when the original list price ratio was 93.44% and the pending price ratio was 97.36%.

What stands out here is the disconnect between these declining ratios and the rise in average sale prices. This suggests that, despite market conditions, sellers in 2024 were even more prone to overpricing their homes compared to 2023. It’s a clear indication that some continued to ignore or misinterpret key market signals, resulting in inflated initial pricing that ultimately required adjustments to attract buyers.

Here are some interesting facts about pricing and time to sell.

- 58 of the 185 (31%) properties that closed in 2024 took 14 days or less to go under contract. They sold at an average of 99% of the original list price.

- 54 of the 185 listings (29%) that closed in 2024 that toook between 14 and 44 days to go under contract sold for 95% of their original list price.

These two groups represent 60% of the listings and were priced well. Look what happens when we go ove 45 days on the market:

- 33 of the 185 listings (18%) that took between 45 an 90 days to go pending sold for an average of only 90% of their original list price. They sold at an average of 96% of their reduced price.

- The other 22% of the listings that took 91+ days to go under contract sold for only 83% of their original list price. They sold at an average of 95% of their reduced price.

Cash Buyers

Cash buyers remained a significant presence in the market throughout 2024. While out-of-state buyers and investors typically dominate this category, this year, I noticed a growing trend of downsizers using the proceeds from their previous homes to make cash purchases. In fact, during six months of 2024, 20% or more of all sales were made by cash buyers.

2024 – The Good and the Bad

Expectations for 2025 – Where are we headed?

Over the past couple of weeks, I’ve noticed a significant shift in buyers’ attitudes. Negativity has all but disappeared, replaced by genuine excitement about purchasing a home. It seems buyers have come to terms with current interest rates and have seen prices adjust enough to make sense for them again. In fact, buyers are once again voicing frustration about low inventory—a clear sign of renewed demand.

This trend aligns with the notable drop in our “months of inventory” metric. If you’ve been following my updates, you know that low inventory levels create an ideal window for sellers. Right now, we’re sitting at just 2 months of supply, a substantial drop from the peaks earlier in 2024, when inventory hit 6 months in both April and May and 5.5 months in September.

Rental Market

After going up in 2022, and coming down a bit in 2023, they stayed about the same in 2024. This can be attributed to a 10% decrease in the number of properties listed for lease. It’s important to rememebr that rental pricing should not be determined solely on recent comps – current competing inventory is just as important if not more. If you are listed at $3000 a month with a house full of carpet, no appliances, and no updates and there’s another house down the street that comes with appliances and is cleaner and/or more updated, the better value is going to lease first – factors like location, views, etc… are not as important to tenants.

Lastly, 2024 was another incredible year in real estate, and I’m beyond grateful to my clients—past, present, and future—as well as to those who continue to trust me as a Steiner Ranch expert and refer their friends and family my way. This year, I proudly closed my 312th Steiner Ranch transaction, and I look forward to helping even more Steiner Ranch friends and neighbors in 2024.

If you’re planning a move or simply have questions about the market, I’m here to help. Feel free to call or text me at (512) 657-7510 or email me at Elicia@SteinerRanchInfo.com. Don’t forget, you can always visit www.SteinerMarketInfo.com for the latest market statistics on both sales and rentals.

Thank you for your continued support—I’m excited for what’s ahead in 2025!